Unlocking Success: Your Guide to Businesses for Sale

The landscape of business opportunities is continuously evolving, and the prospect of acquiring a company for sale can open doors to unparalleled growth. Whether you’re an aspiring entrepreneur, a seasoned investor, or a business consultant, understanding the dynamics of buying and selling businesses is crucial. In this comprehensive guide, we will delve into the intricate world of business sales, focusing on essential strategies, insights, and tips to help you navigate your journey effectively.

Understanding the Market: An Overview of Companies for Sale

The market for companies for sale encompasses a variety of sectors, each with unique characteristics and opportunities. As an investor or buyer, familiarity with these sectors can significantly enhance your decision-making process. Let’s explore some key sectors:

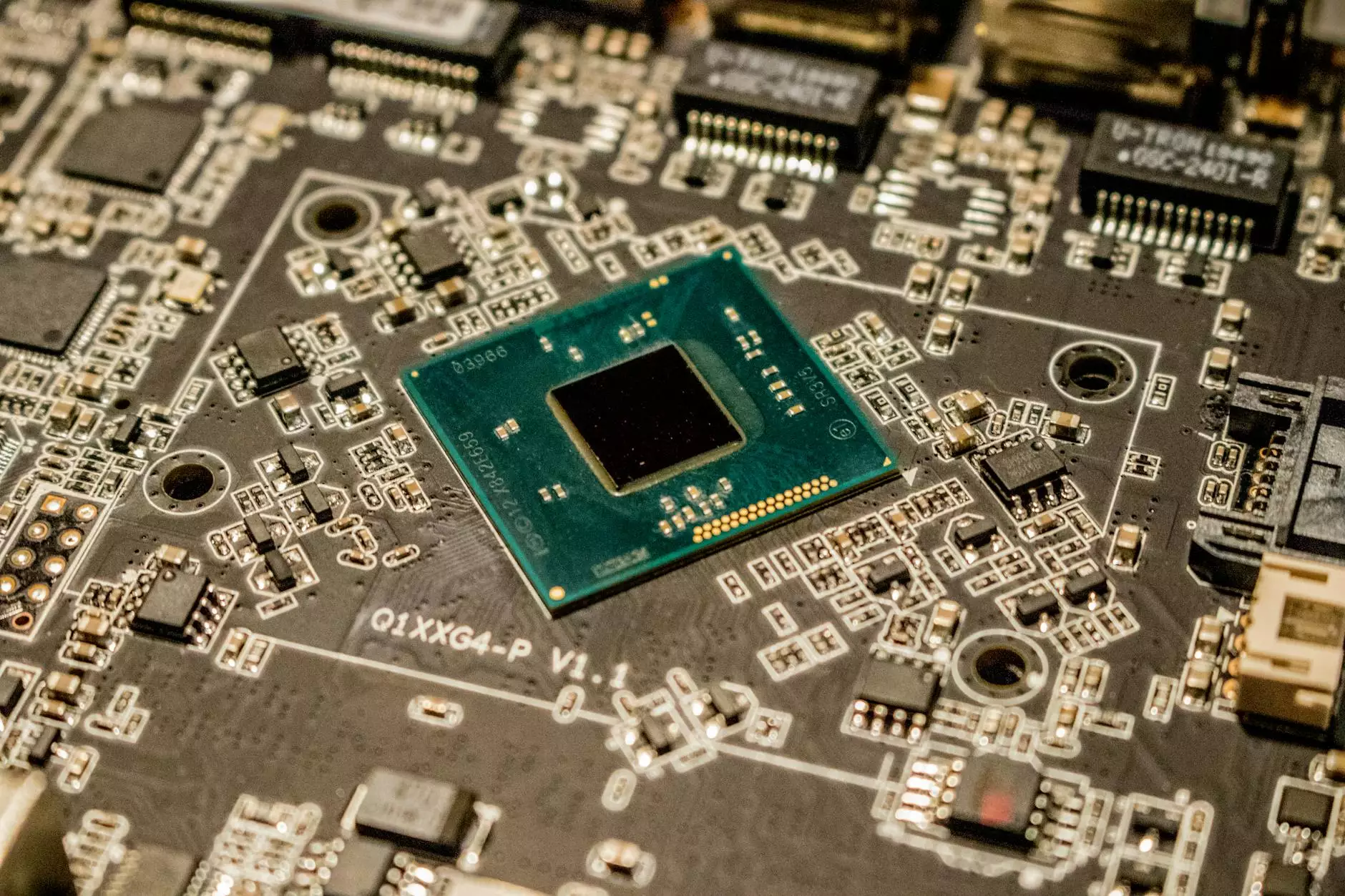

- Technology Startups: In an era where technology drives innovation, investing in technology startups presents significant growth potential.

- Retail Businesses: As consumer behavior shifts, retail businesses—especially e-commerce—remain a promising avenue for investment.

- Manufacturing: Steady demand and potential for scalability make manufacturing businesses attractive for seasoned investors.

- Service Industries: Consulting, healthcare, and personal services continually offer profitable business opportunities.

- Franchises: Established franchises come with built-in recognition, making them appealing to those new to business ownership.

Why Consider Buying a Business?

Purchasing an existing business rather than starting one from scratch offers numerous advantages:

- Immediate Cash Flow: An established business comes with ongoing revenue, allowing you to generate income right away.

- Established Brand and Customer Base: Buying a company with a loyal customer base reduces the time needed for marketing and brand establishment.

- Proven Business Model: An existing business typically has a tested business model, providing a framework for future success.

- Experienced Staff: Acquiring a business often means inheriting a team with operational knowledge, reducing hiring challenges.

Key Steps to Buying a Company for Sale

When considering a company for sale, you should follow a systematic approach to optimize your chances of success. Below, we detail the essential steps:

1. Research and Identify Potential Businesses

Begin by researching available businesses that align with your interests and expertise. Utilize online marketplaces, business brokers, and networking to find suitable opportunities.

2. Evaluate the Business

Once you've identified a potential investment, conduct a thorough evaluation:

- Financial Analysis: Review financial statements, cash flow, profit margins, and overall financial health.

- Operational Assessment: Understand the operational processes to identify strengths and weaknesses.

- Market Positioning: Analyze the business’s position in the market and competition.

3. Conduct Due Diligence

Due diligence is critical to uncover any potential risks and liabilities associated with the business. Engage professionals to assist with:

- Legal Review: Ensure there are no outstanding legal issues or liabilities.

- Compliance Checks: Verify that the business adheres to regulations and industry standards.

- Asset Verification: Confirm the existence and condition of physical and intellectual property assets.

4. Prepare for Negotiation

Negotiation is an art and requires preparation. Aim to determine:

- The fair market value of the business based on your research.

- Your budget and willingness to invest.

- Your terms for the deal and any contingencies.

5. Secure Financing

Explore options for financing your business acquisition. Common sources include:

- Personal Savings: If available, using your funds can simplify the process.

- Bank Loans: Traditional financing options can offer competitive rates.

- Investors: Partnering with investors can provide the necessary capital while sharing risks.

6. Close the Deal

Once negotiations conclude and financing is secured, work with legal professionals to finalize the purchase. Pay attention to the contractual obligations and ensure all agreements are in writing.

The Role of Business Consulting in the Acquisition Process

Engaging a business consulting firm can vastly improve your decision-making process when considering a company for sale. Here’s how:

- Expert Guidance: Consultants bring expertise and insights that can help you identify profitable opportunities.

- Market Analysis: They can provide an in-depth market analysis to help you understand industry trends and potential challenges.

- Valuation Services: A business consultant can assist in valuing a business accurately to ensure you are not overpaying.

- Negotiation Support: Having an experienced negotiator on your side can lead to better outcomes.

Post-Acquisition: Strategies for Success

After acquiring a company for sale, focus on these strategies for ensuring its growth and sustainability:

1. Integrate Effectively

Successful integration of the acquired company with your existing operations is vital. Consider the following:

- Maintain communication to reassure employees and manage transitions smoothly.

- Align the company cultures to create a cohesive environment.

- Implement systems and processes that enhance operational efficiency.

2. Enhance Marketing Strategies

Review and improve existing marketing strategies to attract new customers. Utilize:

- Digital marketing techniques to enhance online visibility.

- Customer engagement initiatives to build loyalty.

- Feedback mechanisms to assess customer satisfaction and adapt accordingly.

3. Monitor Financial Performance

Regularly assess the financial health of the business post-acquisition. Implement performance indicators to track:

- Revenue growth and profitability.

- Expense management.

- Cash flow adequacy.

4. Focus on Innovation

Encouraging innovation can set your business apart from competitors. Foster a culture that:

- Encourages new ideas from employees.

- Invests in R&D (Research and Development).

- Adapts quickly to industry changes.

Conclusion: Seizing Opportunities in the Business Market

The journey of discovering and acquiring a company for sale is both challenging and rewarding. By leveraging strategic insights, conducting thorough due diligence, and engaging in smart post-acquisition practices, you can position yourself for long-term success in the business landscape. Remember, the essence of effective business acquisition lies not merely in the purchase but in the vision and strategy you bring to the table. Whether your goal is to expand your portfolio, diversify your investments, or embark on a new entrepreneurial venture, the world of businesses for sale presents opportunities that, when approached correctly, can lead you to remarkable achievements.

For expert assistance in navigating the dynamic market of businesses for sale, contact Open Fair at openfair.co and take your first step towards entrepreneurial success.